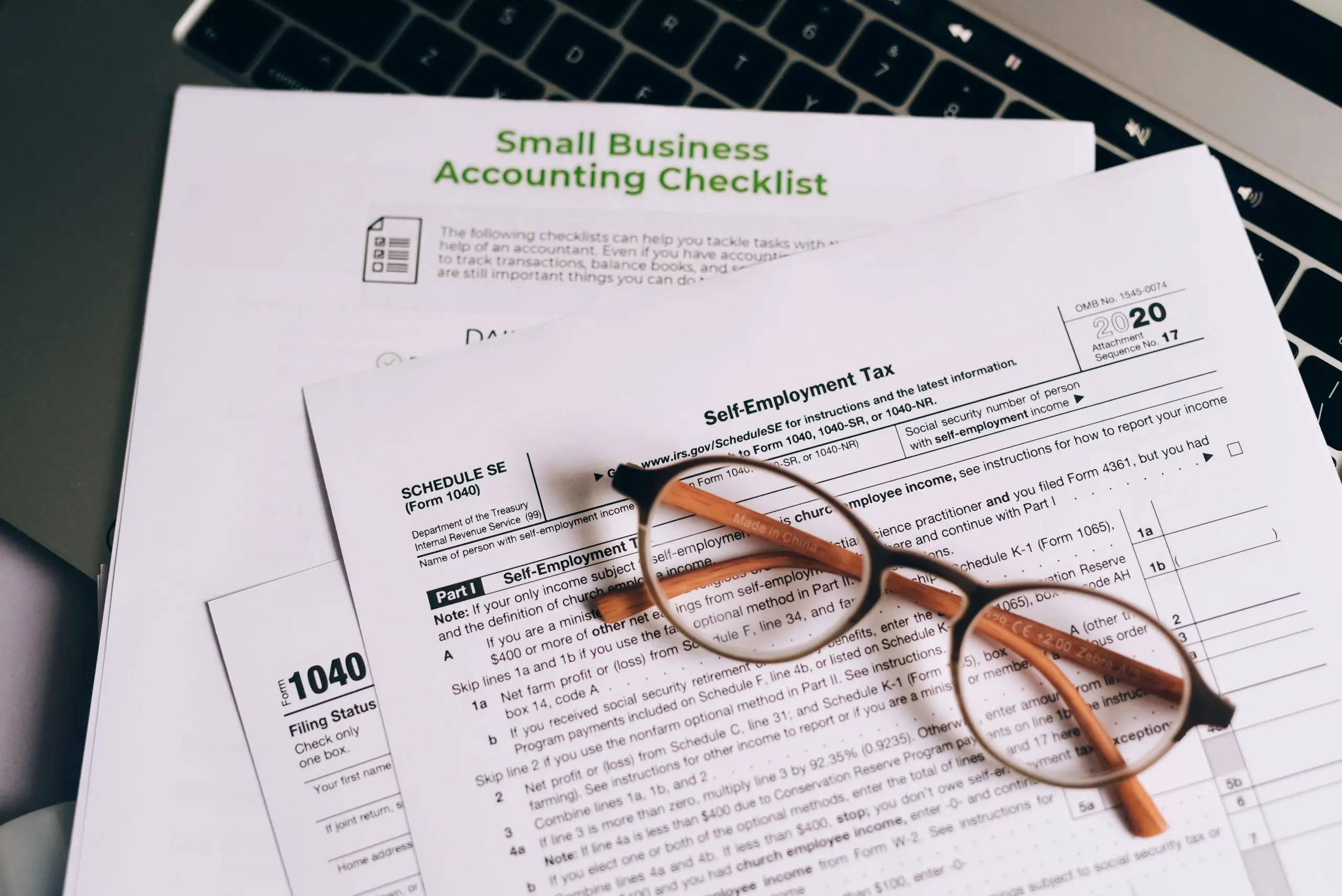

Tax Preparation Business Insurance: Protecting Your Business and Clients

As a tax preparation business owner, you understand the importance of protecting your clients’ financial information. However, have you considered the risks that your business may face? From data breaches to professional liability claims, there are various threats that can impact your business’s financial stability. That’s where tax preparation business insurance comes in. In this article, we’ll explore the different types of insurance coverage that can help protect your business and clients.

General Liability Insurance

General liability insurance is a foundational coverage for any business, including tax preparation businesses. This type of insurance protects your business from third-party claims of bodily injury, property damage, and advertising injury. For example, if a client slips and falls in your office, general liability insurance can cover their medical expenses and any legal fees associated with the claim.

Additionally, general liability insurance can provide coverage for claims of libel or slander. If a client accuses you of making false statements that damage their reputation, this coverage can help cover the costs of a lawsuit.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is essential for tax preparation businesses. This type of insurance provides coverage for claims of negligence, errors, or omissions in your professional services. For example, if you make a mistake on a client’s tax return that results in penalties or fines, professional liability insurance can help cover those costs.

Professional liability insurance can also provide coverage for claims of breach of contract or breach of fiduciary duty. If a client accuses you of not fulfilling your contractual obligations or acting in their best interest, this coverage can help protect your business.

Commercial Property Insurance

Commercial property insurance provides coverage for your business’s physical assets, including your office space, equipment, and furniture. This coverage can help protect your business from losses due to fire, theft, vandalism, or natural disasters.

Additionally, commercial property insurance can provide coverage for business interruption losses. If your office is damaged and you’re unable to operate, this coverage can help cover the costs of lost income and expenses associated with relocating your business temporarily.

Cyber Liability Insurance

In today’s digital age, cyber liability insurance is becoming increasingly important for businesses of all sizes, including tax preparation businesses. This type of insurance provides coverage for losses due to data breaches, cyber attacks, and other cyber-related incidents.

Cyber liability insurance can help cover the costs of notifying clients of a data breach, credit monitoring services, and legal fees associated with a lawsuit. Additionally, this coverage can provide coverage for losses due to business interruption or damage to your business’s reputation.

Conclusion

As a tax preparation business owner, it’s essential to protect your business and clients from potential risks. General liability insurance, professional liability insurance, commercial property insurance, and cyber liability insurance are all important types of coverage to consider. By investing in these types of insurance, you can help ensure that your business is protected from financial losses due to unexpected events.